Big Data Analytics: Driving Innovation in Fintech

Table of Contents

The fintech world has grown rapidly in recent years, thanks to new technologies and changing consumer expectations. Traditional financial institutions aren’t the gatekeepers anymore—fintechs are moving faster and offering smarter, customer-focused solutions.

At the heart of this shift is big data. The amount of data generated every second presents fintech companies with a huge opportunity. With advanced analytics, they can gain deeper insights and make better, faster, and more predictive decisions.

In this blog, we’ll break down how big data is shaping fintech. From improving risk management and customer segmentation to providing personalized financial advice and detecting fraud, big data is changing the way finance works. Welcome to the era of data-driven, tech-powered finance.

Understanding Big Data in Fintech

Big data in fintech comes down to what I call the five Vs:

- Volume: Fintech deals with massive amounts of data, and it’s only growing.

- Velocity: This data isn’t just big—it’s coming in fast, and processing it quickly is a must.

- Variety: From structured data like transactions to unstructured data like social media, the different types of data are crucial.

- Veracity: Not all data is good data. Making sure you’re working with accurate data is a challenge but a necessary one.

- Value: The real power of big data lies in the insights you can pull from it.

Fintech companies are like engines, constantly pulling in data from all over the digital world:

- Customer transactions: Every credit card swipe or online payment generates data that fintechs can analyze for insights.

- Social media: User behavior, market trends, and sentiment are all hidden in every tweet and post.

- Third-party data: Credit scores and market research are just a few examples of external data fintechs use to create fuller customer profiles.

- IoT devices: From wearables to smart devices, fintech can now tap into real-time data streams for analytics.

This data gives fintech companies the edge to make better decisions, faster.

Check Out This Case Study: Data Science App Empowering Venture Capitalists to Find High-Value Startups

How is Big Data Analytics Driving Innovation in Fintech?

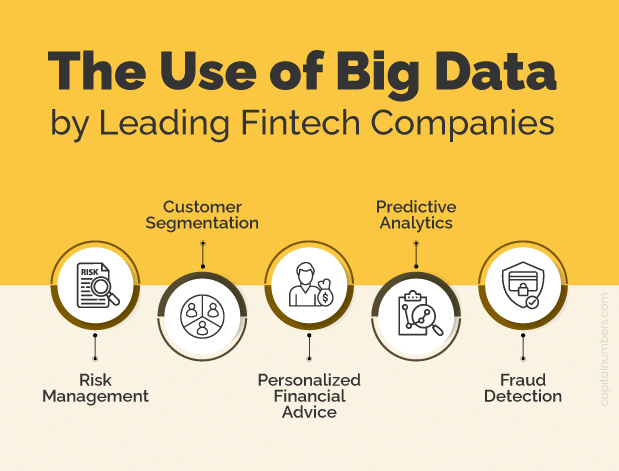

In fintech, big data analytics isn’t just a tool—it’s the engine fueling a new era of financial services. Here’s how top fintech companies are using big data to reshape everything from risk management to customer experience.

1. Risk Management:

In a world of instant transactions and credit decisions, risk management is getting a major upgrade:

- Credit risk assessment: Traditional credit scoring is outdated. Fintechs now use big data to assess creditworthiness in ways that go far beyond old models.

- Fraud detection: Machine learning spots fraud before it happens, identifying patterns humans would miss in vast data streams.

- Market risk assessment: Fintechs can track market trends in real-time, flagging risks before they become big problems.

2. Customer Segmentation:

Big data is moving fintech beyond one-size-fits-all marketing:

- Identifying segments: With big data, fintechs group customers by behavior, preferences, and demographics—offering deeper insights than traditional methods.

- Tailoring products: Personalized, data-driven financial products are the future, and fintechs are creating offerings that fit each segment perfectly.

3. Personalized Financial Advice:

We’ve entered the age of personalized finance, powered by big data and AI:

- Robo-advisors: Algorithms now act as financial planners, offering automated advice tailored to individual goals and risk profiles.

- Personalized recommendations: Fintechs use big data to suggest the right product at the right time, perfectly matching customer preferences.

4. Predictive Analytics:

Fintechs are turning into predictive powerhouses:

- Forecasting trends: Historical data and machine learning help fintechs predict future market movements with precision that was unthinkable just a few years ago.

- Predicting behavior: Fintechs are using data to anticipate customer actions, knowing what they want before they do.

5. Fraud Detection:

Fraud doesn’t take a break, and neither do fintech systems designed to stop it:

- Anomaly detection: Big data flags unusual behavior that could signal fraud, a game-changer for fintech.

- Machine learning models: Fintechs are continuously improving their fraud detection models, learning from past data to stay one step ahead.

- Real-time monitoring: Reactive fraud management is a thing of the past—today’s fintechs monitor transactions in real-time, catching fraud as it happens.

The bottom line? Big data isn’t just helping fintechs stay afloat—it’s giving them the tools to thrive. By leveraging data analytics, fintechs are making smarter decisions, reducing risk, and offering personalized services that traditional banks can only dream about.

Check Out This Case Study: Data Science App Empowering Venture Capitalists to Find High-Value Startups

Big Data Analytics Tools and Technologies

In fintech, data isn’t just a resource—it’s the backbone of innovation. To unlock the full potential of big data, fintech companies need the right tools and technologies to process, analyze, and visualize massive datasets. Here’s how the top players are making it happen.

Popular Big Data Tools and Frameworks

Fintech runs on data, and these big data tools are the engines behind the scenes:

- Hadoop: Think of Hadoop as the heavy lifter for distributed computing. It handles huge datasets across clusters of computers, making big data manageable.

- Spark: When speed matters, Spark is the go-to. This fast computing framework handles everything from real-time data to machine learning, giving fintechs the flexibility they need.

- Kafka: Real-time data is critical in fintech, and Kafka is the platform that processes it. Whether it’s fraud detection or live analytics, Kafka keeps the data flowing.

- NoSQL databases: Forget the old relational databases. Fintechs deal with unstructured, large-scale data, and NoSQL options like MongoDB and Cassandra are built for that.

- Machine learning libraries: AI is reshaping fintech, and libraries like TensorFlow, PyTorch, and Scikit-learn turn data into actionable intelligence. These tools power predictive models, personalization, and automation.

Cloud-Based Big Data Platforms

The cloud is now essential for scalable, on-demand big data processing. Here’s where fintech leaders turn for cloud muscle:

- Amazon Web Services (AWS): From EMR to Redshift and Kinesis, AWS offers fintechs the tools to process and analyze big data at scale.

- Google Cloud Platform (GCP): With solutions like BigQuery and Dataflow, GCP provides high-performance analytics, helping fintechs run powerful queries in real time.

- Microsoft Azure: Azure’s HDInsight, Databricks, and Synapse Analytics give fintechs the ability to process large datasets and run advanced analytics smoothly.

Data Visualization Tools

Data without insights is just noise. These visualization tools turn raw data into actionable insights:

- Tableau: Fintechs use Tableau to build interactive dashboards and reports, allowing teams to see trends and patterns as they happen.

- Power BI: Microsoft’s Power BI turns raw data into visual stories, making it easier for fintech companies to see the bigger picture.

- Python libraries: For custom visualizations, Python libraries like Matplotlib and Plotly allow fintechs to create everything from simple charts to complex visual representations.

The fintech revolution is powered by data, and data-driven financial software development is the fuel driving it. By using the right technologies, fintechs can process massive datasets, uncover valuable insights, and make smarter decisions that keep them ahead of the competition. Welcome to the future of finance, where data is the currency, and technology is the key to staying ahead.

Unlock the full potential of your data. Our data engineering services can help you extract valuable insights and drive innovation. Schedule a consultation to discuss your specific needs.

Big Data Analytics in Fintech: Challenges and Opportunities

Big data is the engine driving fintech innovation, but navigating this data-driven world comes with its own set of challenges. From ensuring data quality to staying ahead of trends, here’s how fintechs can turn these hurdles into opportunities.

- Data Quality: In fintech, bad data leads to bad decisions. Accuracy and consistency are non-negotiable. Fintechs need solid data cleaning and validation processes to get the reliable insights that drive smart services.

- Data Privacy: Fintechs handle massive amounts of sensitive customer information, so protecting that data is a top priority. It’s not just about meeting regulations like GDPR and CCPA—it’s about building customer trust. Strong security measures are critical to safeguarding data in an era of frequent breaches.

- Scalability: As data volumes grow, fintechs need scalable solutions to manage the load. Cloud-based platforms and distributed computing frameworks like Hadoop and Spark are essential for handling big data and delivering real-time insights.

- Talent Shortage: Finding skilled data scientists is tough, and the demand keeps growing. Smart fintechs are investing in training programs to upskill their teams and stay ahead.

Future Trends and Opportunities

- AI and Machine Learning: The combination of AI and big data is where the real breakthroughs happen. Machine learning allows fintechs to automate decision-making, gain deeper insights, and deliver hyper-personalized services at scale.

- Real-time Analytics: In fintech, speed matters. Real-time data processing enables companies to make instant decisions, whether it’s approving a loan, catching fraud, or responding to market changes on the fly.

- Edge Computing: Processing data closer to the source improves performance and reduces latency. With IoT and connected devices on the rise, fintechs can leverage edge computing to improve services like payments and fraud detection.

- Explainable AI: Trust in AI is crucial in finance. Explainable AI models, which make decisions more transparent, can boost customer confidence and meet regulatory requirements.

- Ethical Considerations: As AI becomes more integral to fintech, addressing ethical issues like data privacy, bias, and fairness is essential. Fintechs that build ethical AI systems will set themselves apart and lead the future of finance.

By tackling these challenges and embracing emerging trends, fintech companies can unlock the full power of big data analytics. The future of finance isn’t just about crunching numbers—it’s about making smarter, faster, and more ethical decisions. The fintechs that get this right will drive innovation and set the pace for the entire industry.

You May Also Read: AI-Powered FinTech: The Future of Financial Software Development

Conclusion

Big data analytics is no longer just a bonus for fintech companies—it’s the engine driving innovation and growth. The fintech firms that fully harness the power of big data will shape the future of financial services. Here’s why:

- Improved risk management: Big data helps fintechs identify risks faster and mitigate them more effectively.

- Enhanced customer experience: Personalization is key. With data, fintechs can offer tailored products and services that align perfectly with customer preferences.

- Competitive advantage: In a crowded market, being data-driven is the differentiator. Fintechs that leverage big data will make smarter, faster decisions, staying ahead of the competition.

- Innovation at scale: The true power of big data lies in creating products and services that didn’t exist before—turning insights into groundbreaking innovations.

For fintech companies, the path forward is clear: embrace big data analytics or risk falling behind. By investing in the right infrastructure, talent, and tools, you can unlock the full potential of your data and lead the next wave of financial innovation.

The future of fintech is data-driven, and those who understand its potential will be the ones defining what comes next.